One can view Chelsea’s journey since Todd Boley and Clearlake’s investment as being divided into three distinct phases.

The first phase, labeled “Todd’s Summer and Winter,” featured Boley effectively taking on the role of sports director during 2022 and early 2023. Chelsea aggressively pursued any semi-prominent player available or linked to another major club, leading to signings like Raheem Sterling, Kalidou Koulibaly, Mykhailo Mudryk, and Pierre-Emerick Aubameyang, along with a near signing of 37-year-old Cristiano Ronaldo. Despite a staggering €630 million spent on transfers over two windows, the team found themselves languishing in the lower half of the Premier League table.

The second stage, during Summer 2023, shifted focus to acquiring younger talent. This resulted in mistakes that totaled over €400 million in fees, with even elite clubs managing their transfers more conservatively. Typically, the success rate hovers around 50%. Nevertheless, Chelsea managed to sign two 21-year-olds who could evolve into essential contributors, finishing sixth in the following Premier League season.

This past summer saw Chelsea add several young players with experience in the top leagues. However, none of these deals could be classified as “good value.”

However, they created a squad with such depth that the club could field two distinct lineups for the UEFA Conference League and Premier League. Chelsea secured victory in the Conference League and ended the Premier League season in fourth place, furiously competing with Arsenal and Liverpool.

The new young players arrived this summer and earned a spot back in the Champions League, achieving what seems to be their strongest depth yet, highlighted by stars like Palmer and Kaiseko.

For the last three years, Chelsea resembled a hedge fund masquerading as a football club. They acquired players primarily based on perceived “transfer value” rather than roster fit, yet unexpectedly began winning significant trophies and grew their ability to redirect transfer spending toward finding more stars to support Cesco and Palmer.

But currently, it appears they are struggling, with little clarity on their direction.

Why Chelsea’s Latest Signings Aren’t Game-Changing

Despite scrutiny, most of Chelsea’s actions this summer could be considered defensible.

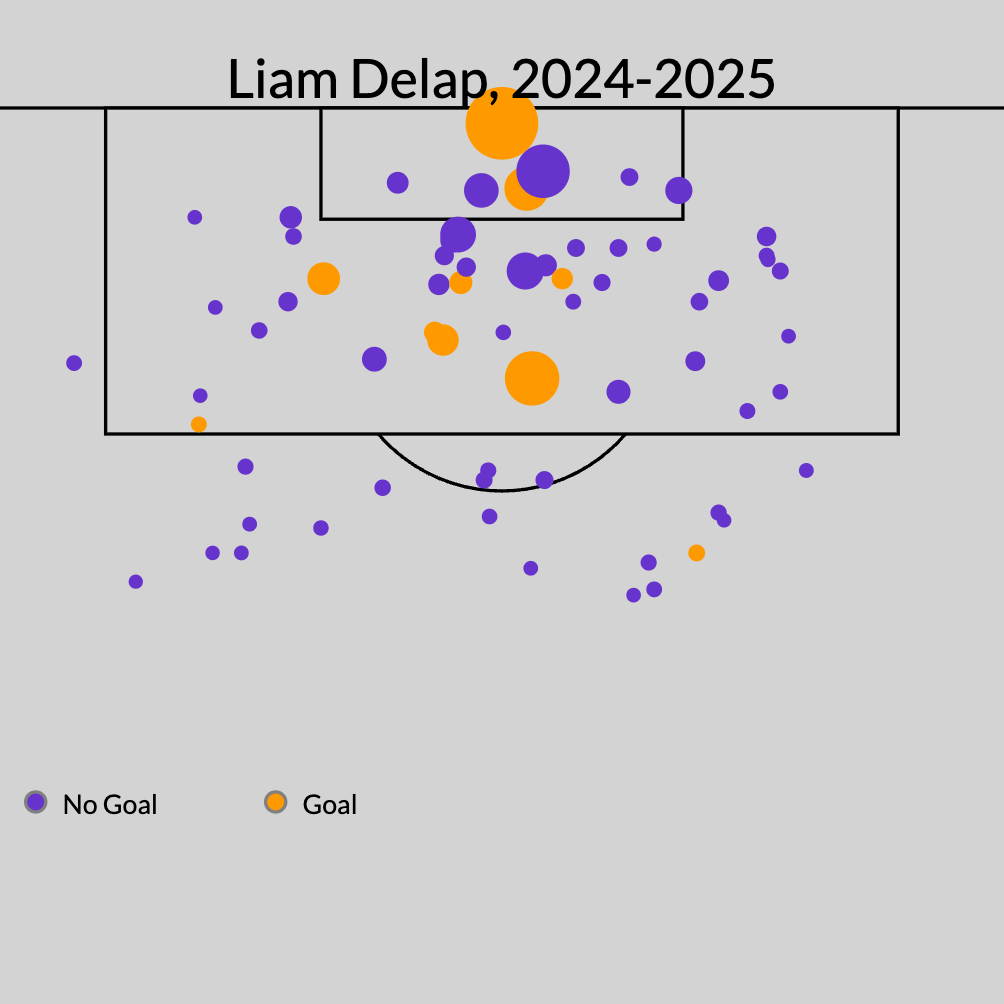

Firstly, they invested €35.5 million in 22-year-old striker Liam Delap from relegated Ipswich Town. Delap scored 10 non-penalty goals and contributed two assists, all while playing on one of the league’s weakest teams. His output exceeded expectations, implying it might not be sustainable.

While he possesses some ball-carrying talent, he hasn’t significantly boosted the offensive unit. Nonetheless, Delap’s youth makes him intriguing, as he occupies a valuable position in the sport. His physical abilities indicate that he could exponentially grow, provided his technical skills and game sense improve.

Clubs often overspend on players based on potential, but Chelsea’s investment in Delap doesn’t fall into that trap. In the worst-case scenario, they could offload him in a year or two, potentially recouping their initial outlay.

Next was João Pedro, a player resembling Roberto Firmino in style but not in terms of production. The 23-year-old Brazilian international is a proficient presser and adept at finding spaces but has struggled to rack up goals and assists, only averaging 0.43 non-penalty goals plus assists over two years at Brighton. The five penalties he scored last season altered the narrative but Chelsea still invested €63.7 million, a price tag meant for a player at the Champions League level who still has much room to grow.

Jamie Gittens, 20 years old, fits into a similar category as Delap. He is an exceptional athlete playing in a highly sought-after position, yet his performance remains below expectations. In two years at Borussia Dortmund, his predicted goals and assists averaged 0.38 non-penalties—somewhat lesser than Joshua Zilky’s numbers for Manchester United this past season, particularly given the Bundesliga’s historical tendency to boost attacking production.

To turn it another way, his output is unlikely to improve significantly moving from Germany to England. Gittens is regarded as a promising prospect, yet Chelsea parted with €64.3 million for what should be a starter at a Champions League quality.

None of these recent acquisitions elevate Chelsea’s prospects significantly, yet their baseline is already promising thanks to the depth amassed over the last year. When assessing Chelsea’s title and Champions League chances, these signings have minimal impact.

Moreover, reports indicate Chelsea is planning to part ways with winger Noni Maduke, who has already settled on personal terms with Arsenal.

1:18

Nicole: Maduceke to Arsenal is meaningless

ESPN’s Steve Nicole believes that Noni Madueke’s potential move from Chelsea to Arsenal “makes no meaning.”

Maduke represents one of the few bright spots in Boehly-Clearlake’s approach, having been acquired at 20 years old from PSV for €35 million. He was one of Chelsea’s most utilized players last season, with compelling underlying numbers suggesting he could continue to improve. While he tends to slow down play, he embodies the type of player who could truly thrive if his metrics align with his creative potential.

Why let go of a 23-year-old like him, especially to a direct rival?

What is the Real Aim of Chelsea’s Strategy?

The new ownership has introduced two notable concepts.

The first involves leveraging financial regulations around transfers. Amortization allows clubs to spread their transfer costs over the length of player contracts, enabling Chelsea to spend big under seven-year contracts without facing serious penalties from football’s governing bodies.

While skepticism surrounds the competitive edge of this strategy, they did renegotiate Palmer’s contract mid-season to retain “value” rather than risk losing him at a lower rate—this showcases a fresh perspective.

The second innovation revolves around their League One affiliate, Strasbourg. Chelsea has effectively created their own feeder club, allowing greater control over player training and tactics, while also maintaining a larger roster. This provides a space to develop players who may not fit into the first team while increasing their overall chances of finding stars.

But what’s the endgame? What is the true objective of this strategy?

Unlike former owner Roman Abramovich, whose interests were directly aligned with fan sentiments, the current ownership does not share the same motivations. Abramovich’s primary concern was to win trophies, stating, “It’s not about making money,” after purchasing Chelsea in 2003. His considerable investments resulted in a plethora of trophies for the club.

Boehly and Clearlake have invested nearly $2 billion in transfer fees, but their financial mindset differs from that of “sugar daddy” owners or those leveraging the sport for reputational gains. Boehly seemed like he was operating on instinct, as if simply chasing the allure of signing high-profile names like Cristiano Ronaldo, yet this is not the driving force behind their ownership. Clearlake, as a private equity firm managing about $75 billion in assets, is focused on profitability, which brings skepticism around their long-term goals.

However, their attempts to creatively finance contracts haven’t alleviated Chelsea’s spending issues. While it may help them avoid UEFA and Premier League sanctions, their expenditure of €1.62 billion on transfers since the summer of 2022 remains unchanged.

Today’s club owners think they can improve revenue by elevating ticket prices and enhancing facilities, a notion particularly prominent among American investors. In football, however, player wages consume a significantly larger portion of club revenues compared to U.S. sports. Close to two-thirds of income in the Premier League is allocated to wages, whereas it hovers around 50% in major American leagues. In soccer, winning translates to spending money wisely.

If Chelsea fails to secure victories, it would be perceived as a failure of epic proportions. They have invested over $5 billion to acquire Chelsea, but the true value in sports ownership emerges from appreciating team valuations over time. Typically, this requires consistent winning—a task that’s challenging without the built-in advantages American leagues provide, such as drafts and competitive balance.

It’s puzzling to believe that the current leadership of Chelsea is unaware of these dynamics. Yet it’s equally challenging to grasp their strategy. Despite significant financial investment, the club lacks a coherent plan to improve results. Their early performance seems disconnected from the financial commitment made. At present, one must question whether the club is worth the $5 billion its owners paid.

After years of disorganization, it finally appeared that Chelsea was gearing up for a competitive resurgence. The current summer’s developments suggest otherwise, as the owners may view the roster solely as names linked to their financial value, treating player transactions like mere business deals. Ultimately, the pressing question is how to secure more victories.

Fan Take: This situation at Chelsea reflects a broader trend in soccer where financial strategies often overshadow actual performance and fan engagement. As clubs navigate ownership models focused on profitability, it raises concerns about the true essence of soccer being lost amid corporate ambitions.